How Close Is the Lithium-Ion Battery Industry to the $100 / kWh Milestone?

This story is contributed by Dr. Francis Wang (CEO, Nanograf)

The holy grail of lithium-ion battery technology has been achieving the $100 per kilowatt-hour milestone, the price at which electric vehicles will be cost-competitive with internal combustion engine-based cars.

Thanks to improvements in battery chemistry, manufacturing logistics, and even changing geopolitical forces, the industry is closer than ever to reaching it.

A plethora of battery technology startups is leading the charge to get to and even exceed the goal, potentially ushering in a new electric-vehicle driven future.

NanoGraf scientist applying silicon slurry onto a current collector to create an anode electrode for lithium-ion battery tests.

For years, the preoccupation of many in the lithium-ion battery industry has been a simple question: when will these batteries reach the $100 / kWh milestone? It’s not a matter of idle speculation, either. It’s the point at which Lithium-ion batteries would make electric vehicles (EVs) competitive with those powered by internal combustion engines.

In other words, at $100 / kWh, lithium-ion batteries will make a much greener energy system possible.

And the news is good: analysts predict that we’ll hit the milestone as soon as 2023.

Exciting as that is, though, it’s not the whole story. To understand where the lithium-ion battery industry is headed, it’s important to understand the context around where it’s been, what forces are driving it forward, and what geopolitical factors might speed or slow its progression.

Background: A Decade of Rapid Progress for Li-Ion Batteries

Between 2012 and 2020, the cost of lithium-ion batteries dropped 82 percent, according to research by IHS Markit. In 2016, for example, Tesla reported a $230 / kWh cost for its batteries that it has shrunk to $127 / kWh last year. According to Bloomberg New Energy Finance, the industry average battery costs (cell + packaging) have declined from $288 to $176 between 2016 and 2018. (In 2010, a lithium-ion battery pack cost US$1,183 per kilowatt-hour. Less than a decade later, the price had dropped to nearly a tenth of that at US$156/kWh in 2019, according to BloombergNEF data)

Figure 1. Battery pack price (US$ per kWh) from 2010–2019 (Source: BloombergNEF)

Those improvements happened thanks to two forces: first, ongoing R&D at the various companies producing these batteries, and second, decreasing costs of component materials. With respect to R&D, competition among these companies has pushed researchers to find ways to make their batteries more powerful and more durable, with LG Chem’s work with Tesla being one recent example.

The other force at play is the fact that the component materials have gotten less expensive. So as Li-ion batteries have gotten better performance-wise, they’ve also become cheaper. Tesla has played a big role in pushing us toward this goal by providing an immediate commercial application for the battery technology being developed and making the clear case that there’s consumer demand for that application. Maybe the best part, though, is that this momentum isn’t slowing.

The Geopolitics of Lithium-Ion Batteries

Nothing happens in a void, of course, and the geopolitical realities that surround technological and commercial forces will also play a role in this technology’s future.

Today, Asia is the largest player in Li-ion battery production, with 80 percent of the world’s production capabilities. It’s expected to remain dominant in the next decade, but other areas are expected to gain ground. Europe, for example, could be responsible for up to a quarter of the global pipeline by 2030.

In North America, Tesla’s production facilities (the world’s fourth-largest) are the major player. The newly elected Biden Administration could have a big impact on how large a role those facilities have and even on how much progress the Li-ion battery industry makes in the coming years.

For example, Biden has announced plans to push a “made in all of America” agenda to drive innovation in the United States. Part of that includes $300 billion in R&D spending over four years, a 60 percent increase from 2018 levels.

That could be transformative. Federal investment in R&D has plummeted since the middle of the 20th century when such investments yielded the technology that defines life today: GPS, the internet, the personal computer, and more.

Figure 2. Graph showing R&D expenditures as a percent of the federal budget from 1962–2020, showcasing the decline in both defense-related and nondefense-related investments. (Source: Congressional Budget Office of the United States.)

“Could” is the operative word, though. If those investments incentivize bold experimentation rather than what’s worked in the past (and for the past), they will pave the way for a green-tech future our children and grandchildren will be grateful to be a part of.

How We’ll Get to $100 / kWh (and Beyond)

Improved technology isn’t the only factor expected to help the industry reach the $100 / kWh milestone in the next three years. The less-sexy (but just as compelling) side of the equation is improved logistics. For example, analysts expect the global capacity to develop Li-ion batteries to quadruple by 2030, based on current manufacturing facilities, those in development, and those being planned. Many of these factories will be larger than the ones that exist today, capable of producing terawatts rather than gigawatts of energy, ultimately helping the industry achieve economies of scale. That alone signals that investors see clear commercial applications for Li-ion batteries. In a path similar to landlines versus cell phones, as Li-ion batteries become cost-competitive with legacy technology, demand will soar.

Then there’s the fact that the costs of both manufacturing and raw materials are expected to fall in the coming years. That’s an important driver in pushing us closer to $100 / kWh, because raw materials account for as much as 60 to 70 percent of Li-ion batteries’ cost, according to a 2019 report from Avicenne Energy. These non-tech forces will continue to play an important role in ushering in an era where Li-ion batteries enable a big change in how we use energy — but the battery technology itself, of course, plays the biggest role.

Among the most prominent tech developments driving performance improvements are silicon anodes. Today, most Li-ion batteries rely on graphite anodes, which are stable in charging and discharging cycles but allow only a fraction of the energy density possible with silicon (Tesla’s Battery Day presentation, shared below, highlights this difference.) In an electric vehicle, that can mean the difference between your battery getting you about two-thirds of the way to Detroit from Chicago on a single charge, versus getting you all the way there on the same charge.

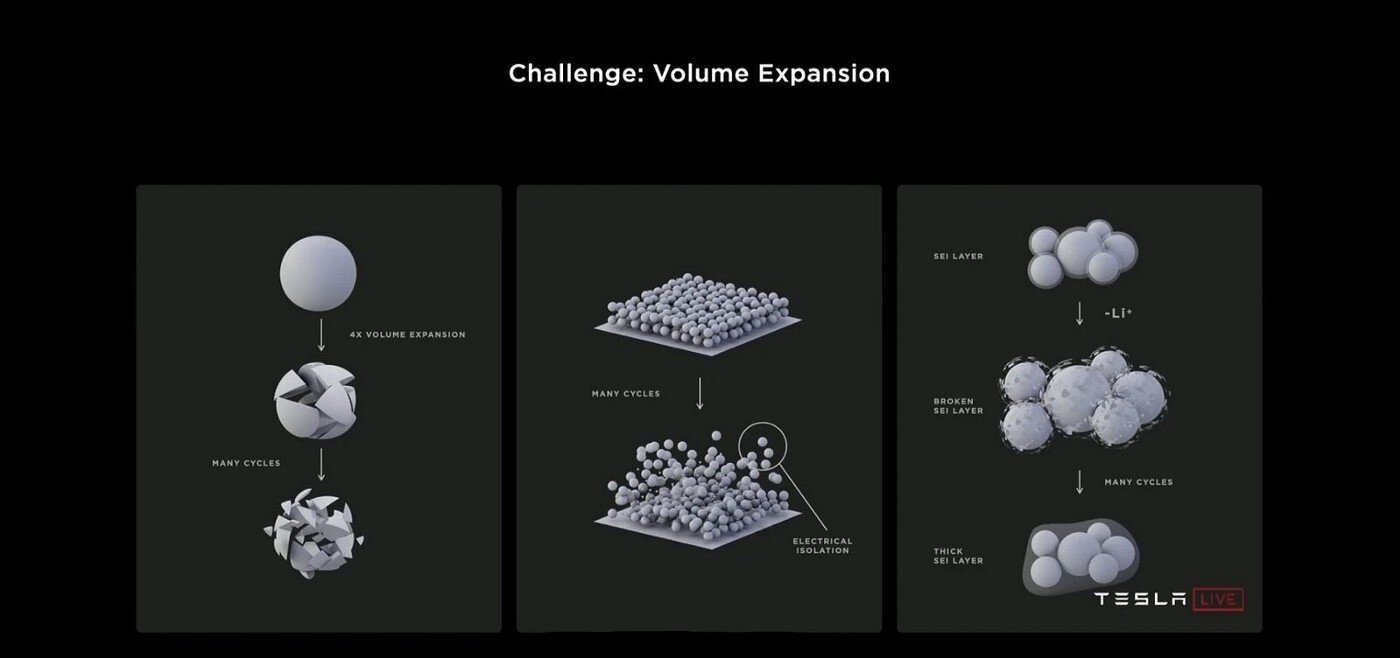

Figure 3. Slide from Tesla Battery Day showing the problems of silicon anode volume expansion over multiple charge cycles.

Improving batteries’ energy density would greatly improve their overall efficiency and would therefore be a key part of reducing costs per kWh. The problem is that silicon, which has a much higher energy storage capacity than graphite, degrades rapidly in charge and release cycles. Specifically, it expands to up to four times its starting size, which can introduce cracks that impact the formation of stabilizing SEIs (Solid Electrolyte Interface) and create electrical disconnection, ultimately making it less effective than graphite.

Much of the most exciting innovation in battery technology right now is around how to overcome that problem. For its part, many large battery manufacturers are now incorporating <10% Si into their graphite anodes, enabling some energy density improvements, but not enough to reach the critical cost milestone. That improves performance, but not enough to get to our crucial cost milestone. Some companies are attempting to use silicon metal nanoparticles to get around the problem, but the complex nature of the engineering process makes this technique cost-prohibitive as well. A more promising solution could be the approach taken by companies that are finding ways to provide external architectures that can expand and contract without deforming the rest of the battery.

Figure 4. Slide from Tesla Battery Day showing how raw metallurgical silicon can be used to overcome problems created from multiple charge cycles.

At NanoGraf, for example, we encase a proprietary silicon-based electroactive material with proprietary surface materials that provide SEI stabilization and prevention of electrical disconnection. Another startup is experimenting with silicon film on copper foil wrapped in a protective coating. Still, other startups are experimenting with other ways to introduce silicon into the anode, including Sila Nano, Amprius, Enevate, QuantumScape. While batteries with these advanced silicon technologies are not yet in EVs, they’ll soon be in smaller consumer technology. And when they do make their way to cars, we expect to see significant increases in driving range (up to ~30%) and substantial decreases in required charge time (think: five minutes of charging to power 400 km of driving).

When these technologies hit EVs, they’ll eliminate many of the consumer-side adoption hurdles that currently exist (i.e., limited driving range and too-long charging times). Given these developments, it’s easy to see why IHS predicts that Li-ion batteries will actually be well below the $100 / kWh benchmark — to $73 / kWh — by 2030. Tesla’s Musk has indicated that he’s already got his sights set on the $50 / kWh mark.

How Startups Are Leading the Way

The kind of bold experimentation that has pushed the Li-ion battery industry to where it is today and will continue to push it to $100 / kWh and beyond is happening in startups and organizations with agile, startup-like mindsets.

As commentators on Tesla’s 2020 Battery Day noted, getting to where industry leaders like Elon Musk want to be will involve some trial and error. It will involve failures. And the companies best positioned to fail fast, learn from those failures, and set up the next experiment are startups.

Think of it this way: before the introduction of the iPhone, things like Uber and WhatsApp would have been inconceivable. And yet they (and applications like them) have utterly changed daily life. The Li-ion battery offers a similar potential, and startups will be responsible for not only the innovations that make these batteries commercially viable in dozens of applications but also the applications that will use these batteries to transform our lives.